DANIEL LAWSON

Northeastern University

Solar + Storage Conversion

Goal: Design a solar panel system with partial storage for several buildings at NEU and build a financial model that makes the project viable and profitable.

Background

This project was the final assignment for my Renewable Energy Development class at NEU. We were given the current electricity demand and cost figures for the two largest buildings on campus and were tasked with building a design to fit them with solar panels, a financial model that is good for the school and us as developers, and a design for a battery storage system to take advantage of several government incentives.

Solar Array Design

As a group, we chose to use REC400AA Pure panels because of their performance, low degradation rates, and competitive pricing. We also chose a Sunny Tripower Core inverter because of its 50kW capacity and exceptional efficiency.

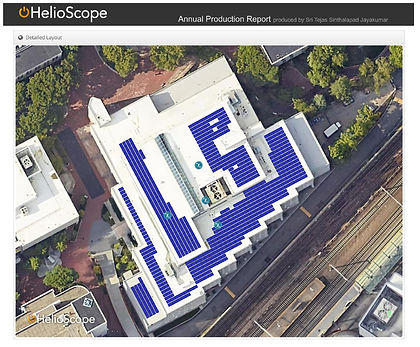

With these components, we used HelioScope to help us with automating the layout. We had to manually tweak the designs to allow for more efficient tilt angles, minimize shading, create HVAC paths and fire setbacks, and make sure the total size corresponded with the most enticing government incentives.

Here is an example of one of the six building layouts with the following specs.

● Modules: REC400AA Pure (400W)

● Inverter: Sunny Tripower Core 1/US(SMA) 50W

● Number of panels: 624

● Module DC nameplate: 249.6kW

● Inverter AC nameplate: 200kW, DC/AC ratio: 1.25

● Annual Production: 295.1MWh

● Performance Ratio: 80.2%

● kWh/kWp: 1,182.5

Storage Design

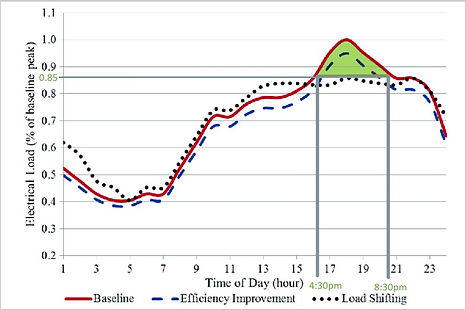

Because we did not have real-time demand data, we scaled the total demand to a generic demand curve with peak shaving occurring between 4:30pm and 8:30pm.

15% of max demand * 4 hours

-

Marino: 320kWh

-

Snell: 480kWh

To maximize the revenue from incentives, the BESS would operate via the following logic.

Power Purchase Agreement (PPA)

Our group's PPA was unique in the fact that it was split into two different sections. We felt this was the best option because it gave NEU great upfront savings, and allowed us as developers to get the most long-term revenue from incentives.

For the first five years of operation, the storage systems will be used to shave NEU's peak demand and the high demand charges from the utility. This energy will be at no cost to NEU and will have an estimated total saving of $400k. In return, the developers do not need to pay a roof lease for any of the six buildings.

For years six through twenty-five of operation, the storage systems will use half of their capacity to shave NEU's peak at a price of 50% of the market value, thus decreasing NEU's demand charges and demand in total. This has an estimated saving of $1.2M.

In summary, NEU gets free peak shaving for 5 years, followed by 20 years of peak shaving at 50% of the market rate. In return, the developers do not need to pay a lease and are free to sell non-peak energy to the grid to maximize incentives.

Building 1 (Marino)

Building 2 (Snell)

Financial Model

The following table is a summary of the varied inputs and key outputs of the financial model. The loans were taken to maximize the levered IRR while keeping the DSCR above 1.12. It is important to note the IRRs are relatively high, and this was done to leave room for negotiation with NEU.